Decentralized finance (DeFi) relies on smart contracts – self-executing blockchain programs that automate financial processes without needing human input. These contracts manage tasks like liquidating under-collateralized loans, adjusting interest rates, and automating trades, making DeFi faster, more reliable, and cost-efficient.

Key takeaways:

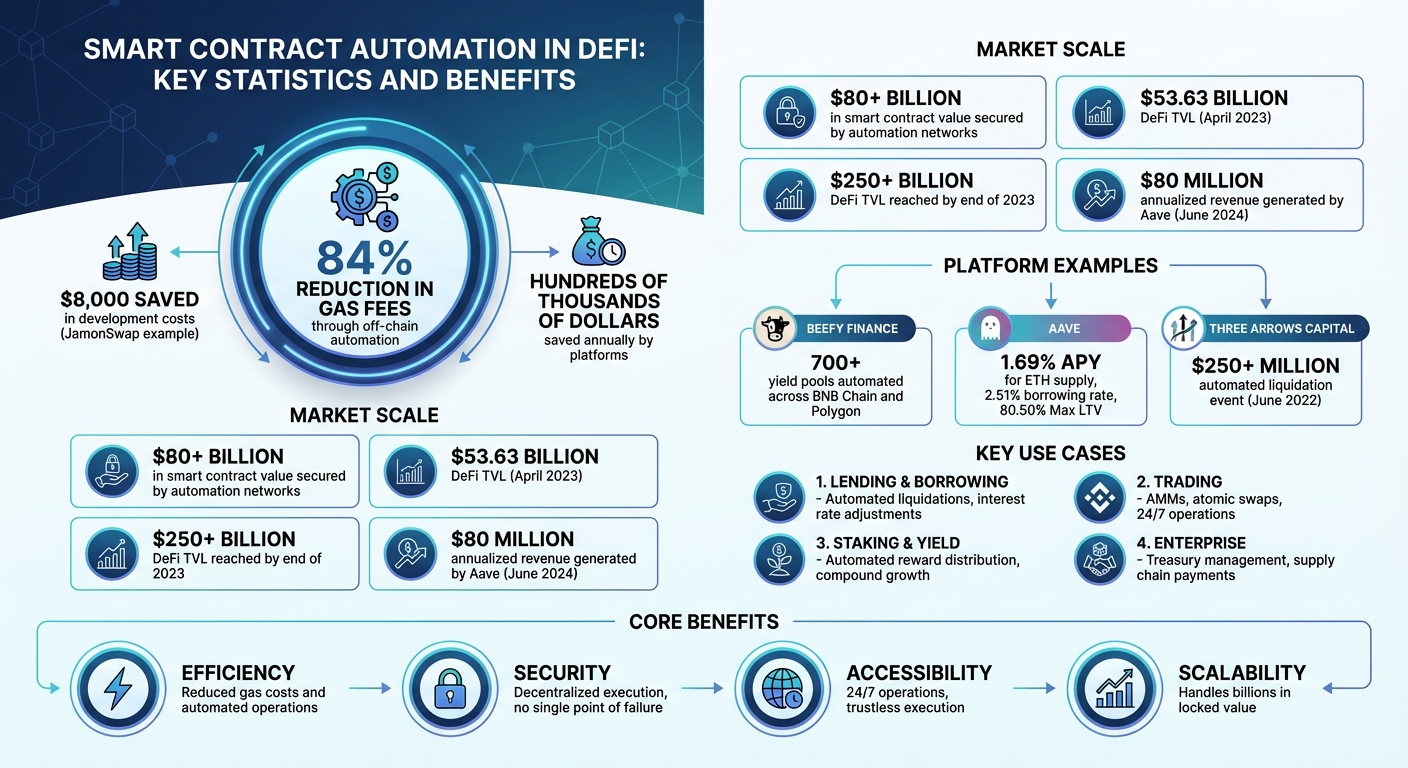

- Efficiency: Smart contracts reduce gas fees by up to 84% by automating complex tasks off-chain.

- Security: Decentralized automation eliminates reliance on centralized servers, reducing risks like downtime or key exposure.

- Applications: From lending and borrowing to trading, staking, and yield farming, automation simplifies DeFi operations.

For example, platforms like Aave, Uniswap, and Beefy Finance use automation to manage loans, optimize liquidity, and compound user rewards. The result is a trustless, 24/7 operational system that improves financial processes while cutting costs.

Why it matters: Automation through smart contracts is reshaping DeFi, offering a scalable and secure way to handle billions in locked value.

Smart Contract Automation Benefits in DeFi: Cost Savings and Efficiency Gains

What Are DeFi Automations? | Crypto 101

Lending and Borrowing Automation

Smart contracts are transforming DeFi lending by automating tasks like fund delegation, interest rate calculations, and collateral enforcement – completely eliminating the need for human oversight. For example, when using a platform like Aave, borrowers lock cryptocurrency into a smart contract as collateral. The contract enforces rules, such as the Maximum Loan-to-Value (LTV) ratio. As of June 2024, Aave offered a 1.69% APY for supplying ETH and charged 2.51% for borrowing it, with a Max LTV set at 80.50%.

Interest Rate and Collateral Management

DeFi platforms use smart contracts to adjust interest rates dynamically in response to supply and demand. If more users borrow ETH, borrowing rates rise, while an increase in supply causes lending rates to drop. Collateral management follows a similar logic: for instance, supplying 1 ETH allows you to borrow up to 0.8050 ETH, aligning with the 80.50% LTV threshold. These smart contracts continuously monitor collateral using real-time on-chain price feeds. If your debt approaches 83% of your collateral value – the liquidation threshold – the system triggers liquidation to ensure the protocol remains solvent. By automating these processes, Aave generated over $80 million in annualized revenue as of June 2024. This real-time adaptability also supports efficient automated liquidation systems, safeguarding lender funds.

Automated Liquidation Mechanisms

Smart contracts utilize decentralized automation networks to monitor loan health off-chain. These networks calculate collateralization ratios for thousands of positions and execute on-chain transactions to initiate liquidation when loans fall below their thresholds. This approach slashes gas costs by roughly 84% compared to traditional on-chain monitoring methods.

A notable example occurred in June 2022 when Three Arrows Capital faced an automated liquidation on Aave involving over $250 million. The smart contract automatically liquidated the collateral once its value dropped below the maintenance threshold. This event highlighted how automated enforcement mechanisms can protect protocol solvency even during volatile market conditions. The seamless coordination between collateral tracking and swift liquidation enhances the security and efficiency of DeFi platforms. As the ICR Research Team puts it:

"A piece of code or a smart contract can take care of all the delegation of funds. In case the borrower fails to repay, AAVE smart contract can simply liquidate the collateral and pay back the lenders".

Liquidity and Trading Automation

Smart contracts have transformed traditional trading by replacing order books with liquidity pools that operate 24/7. These pools, managed by Automated Market Makers (AMMs), use pre-set formulas to determine prices and execute trades. Users can deposit token pairs into these pools and earn fees in return.

Automated Market Makers (AMMs)

AMMs run independently, constantly adjusting liquidity pools as trades happen. For instance, when swapping ETH for USDC on a platform like Uniswap, the AMM automatically rebalances token ratios to keep the pool stable. Uniswap v3 introduced a feature called concentrated liquidity, which allows liquidity providers to define specific price ranges for their deposits, making the system more efficient.

In 2021, the decentralized exchange DODO integrated Chainlink Automation to support automated limit orders. This feature lets users set specific buy or sell prices, with off-chain monitoring ensuring trades execute when the conditions are met. DODO founder Lei Mingda highlighted the benefits, saying:

"Chainlink Automation sets the industry standard for secure smart contract execution, and we’re excited to empower traders with new tools for capitalizing on market movements, even when they are not awake".

This integration also saved JamonSwap approximately $8,000 in development costs.

Visor Finance took automation further by using Chainlink Automation to manage liquidity positions on Uniswap v3. Their system automates tasks like reinvesting earned fees, managing limit orders, and adjusting price ranges based on set thresholds. These automated processes help liquidity providers maximize asset use and optimize returns without needing to intervene manually. Beyond AMM optimization, smart contracts also streamline trade settlements for enhanced efficiency.

Atomic Swaps and Settlement

Smart contracts make atomic swaps possible – peer-to-peer trades that either complete entirely or fail, removing counterparty risk. These contracts ensure all conditions on the blockchain are verified before any funds are transferred, enabling secure, trustless settlements without middlemen. Decentralized automation networks handle the execution once conditions are met.

Synthetix, a decentralized derivatives platform, uses automation to settle Kwenta exchange fees and distribute staking rewards. By automating the closure of fee periods when deadlines are reached, Synthetix eliminates the need for centralized servers or manual oversight. Additionally, offloading complex calculations to off-chain processes has reduced gas fees for settlements by about 84% compared to fully on-chain operations.

These advancements highlight how automation is not just improving efficiency but also building trust in DeFi trading systems.

Staking and Yield Optimization

In the world of DeFi, smart contracts have revolutionized staking and yield strategies by automating reward calculations and reinvestments. This eliminates the need for manual token claims, much like how lending and trading automation streamline other financial processes. The result? A seamless and decentralized approach to managing rewards.

Automated Staking Rewards

Smart contracts rely on external triggers to execute and distribute staking rewards. Decentralized automation networks use nodes, known as "Keepers", to perform off-chain simulations (checkUpkeep) before executing on-chain actions (performUpkeep) to distribute rewards. These triggers can be based on time, events, or specific logic.

For instance, Synthetix employs Chainlink Automation to close fee periods and automatically distribute Kwenta exchange fees and staking rewards. Similarly, Alchemix utilizes automation to harvest yield from user collateral daily, applying it directly to debt repayment without requiring any manual intervention. This decentralized approach not only removes single points of failure but also eliminates the need for developers to manage centralized servers or cron jobs.

Yield Farming Automation

Yield aggregators take automation a step further by shifting funds between protocols to secure the best returns. These platforms handle everything from harvesting rewards to swapping them for vault assets and reinvesting profits, ensuring consistent compound growth.

Take Beefy Finance as an example. It automates the process of harvesting and reinvesting rewards across its yield pools, optimizing compound growth. The team behind Beefy Finance highlighted the benefits of this approach:

"Chainlink Automation enables us to trigger our yield harvesting and compounding functions in a decentralized manner, resulting in greater reliability, transparency, and ease-of-use across all our yield optimization strategies".

Another example is Paçoca, which uses automated smart contracts to manage its Sweet Vaults. By performing complex calculations off-chain, the protocol has significantly reduced operational costs. The Paçoca Core Team shared:

"By leveraging Chainlink Automation to perform secure off-chain computation, the Paçoca protocol can now reliably auto-compound its Sweet Vaults in a decentralized, trustless, and tamper-proof manner".

These tools also play a crucial role in managing concentrated liquidity positions on platforms like Uniswap V3. They adjust price ranges and reinvest fees based on market conditions, allowing users to earn compound interest effortlessly while maintaining high capital efficiency across liquidity pools. This kind of automation not only simplifies yield farming but also boosts the overall efficiency of DeFi operations.

sbb-itb-7e716c2

Enterprise Applications of DeFi Automation

Businesses are increasingly turning to automation to simplify treasury operations, reduce manual work, and avoid the risks associated with centralized systems. By using decentralized automation networks, companies can handle complex financial workflows without exposing private keys on centralized servers or relying on manual developer interventions. While DeFi automation initially focused on retail lending and trading, enterprises are now applying it to areas like treasury management and supply chain operations. This shift brings the advantages of automation to more intricate business processes.

Treasury and Payment Automation

Smart contracts have become a key tool for automating essential treasury functions. They work based on three types of triggers:

- Time-based schedules: For tasks like monthly payroll.

- Custom logic: For actions such as rebalancing portfolios when asset ratios deviate.

- Log-based triggers: For responding to on-chain events, like invoice confirmations.

This automation removes the need for manual intervention in routine processes, such as recurring payments, subscription renewals, and compensating contributors.

To enhance security, enterprises often use multisignature (multisig) contracts – like "3 of 5" or "4 of 7" signatures – to prevent unauthorized transfers and reduce single points of failure. These systems can also monitor wallet balances and automatically trigger "top-up" actions when funds drop below a set threshold, ensuring seamless operations without constant manual monitoring.

Additionally, moving complex treasury calculations off-chain helps cut operational costs while maintaining execution efficiency. These same automation principles extend to invoice and supply chain management, as outlined below.

Supply Chain and Invoice Management

In supply chain operations, smart contracts simplify payments by automatically executing transactions upon shipment confirmations or invoice approvals. This reduces processing delays and administrative expenses. These systems are particularly reliable during periods of market volatility, where centralized solutions often falter, thanks to professional node operators ensuring smooth execution.

To optimize costs and maintain payment integrity, enterprises can handle intensive computations off-chain and only trigger on-chain actions when specific conditions are met. Adding minimum wait periods further safeguards against fund mismanagement. This approach balances cost savings with secure and efficient payment execution.

BeyondOTC‘s Role in DeFi Automation

BeyondOTC specializes in bridging institutional capital with the technical execution needed for DeFi automation. As decentralized finance protocols increasingly depend on smart contract automation to manage billions in locked value, both institutional clients and new projects require expert guidance to navigate this intricate ecosystem. BeyondOTC ensures these projects have the liquidity and automated infrastructure they need to operate securely and efficiently.

TVL Funding Advisory

For institutional clients looking to tap into DeFi protocols using smart contract automation, BeyondOTC offers comprehensive Total Value Locked (TVL) investment solutions. These solutions utilize decentralized automation, such as external keepers, to handle tasks like yield harvesting. This approach not only minimizes gas fees but also eliminates the risks associated with centralized failure points.

The benefits of automation are evident in projects like Beefy Finance, which has integrated decentralized automation across more than 700 yield pools on BNB Chain and Polygon. With effective TVL strategies in place, securing deep liquidity for automated trades becomes a critical focus.

OTC Trading Solutions

BeyondOTC also facilitates large-scale cryptocurrency transactions by connecting institutional clients with OTC desks and liquidity providers. This service is essential for supporting high-value, automated trades. In April 2023, DeFi’s Total Value Locked reached $53.63 billion, eventually surpassing $250 billion by the end of the year. Such growth underscores the importance of deep liquidity for executing large trades without slippage on decentralized exchanges. By providing access to OTC desks, BeyondOTC ensures the liquidity required for seamless, automated trading.

Networking and Market Entry Support

For DeFi projects leveraging smart contract automation, strong connections within the ecosystem are vital. BeyondOTC links clients to key players such as decentralized network node operators, market makers, and professional DevOps teams. They also facilitate introductions to centralized exchanges, decentralized exchanges, launchpads, and market makers, creating a streamlined path for market entry and optimized protocol operations.

This networking support is particularly valuable for projects employing concentrated liquidity strategies, like those on Uniswap v3. Automated rebalancing in these strategies requires close coordination with market makers to ensure efficient asset utilization. By serving as a central point of contact for accessing a wide network of partners, BeyondOTC allows projects to concentrate on their automation strategies while ensuring they have the necessary infrastructure for reliable execution.

Key Takeaways on Smart Contracts in DeFi

Cost and Time Efficiency

Smart contracts bring a whole new level of efficiency to DeFi protocols by automating operations, cutting costs, and saving time. For instance, platforms like Civilization, JamonSwap, and Entropyfi have shown how automation can slash gas fees by about 84%, save hundreds of thousands of dollars annually, and free up valuable engineering resources for other tasks.

The benefits go beyond just saving money. Decentralized automation networks, which use rotating node selection, help stabilize gas costs even during times of heavy network traffic. These networks are already playing a big role, securing over $80 billion in smart contract value.

Broader Accessibility and Transparency

Automation is making complex DeFi strategies easier for everyone, even for users who aren’t tech-savvy. Platforms like Beefy Finance and Paçoca have introduced automated yield harvesting and compounding, creating a “set-and-forget” experience. This allows users to benefit from decentralized operations without needing to dive into manual processes.

What’s more, smart contracts run around the clock, executing financial actions exactly as programmed – no centralized intermediaries needed. This autonomous nature eliminates single points of failure while ensuring that all transactions are transparent and verifiable. With these improvements in accessibility and trust, DeFi is poised to embrace even more groundbreaking developments.

Future Potential in DeFi

The automation of smart contracts isn’t just about immediate gains; it’s also opening doors to exciting new possibilities in DeFi. Protocols are moving closer to full decentralization, doing away with manual DevOps and centralized servers. Emerging trends include dynamic NFTs that change based on real-world data, cross-chain automation that coordinates actions across multiple blockchains, and advanced DAO governance tools for managing treasuries and paying contributors.

Lei Mingda, Founder of DODO, highlighted this progress:

"Chainlink Automation sets the industry standard for secure smart contract execution, and we’re excited to empower traders with new tools for capitalizing on market movements, even when they are not awake".

Additionally, advanced off-chain computation is enabling more sophisticated strategies. Examples include automated rebalancing of liquidity positions on Uniswap v3 and self-repaying loans that use yield to reduce debt automatically. These innovations allow teams to focus on their core ideas rather than maintaining infrastructure, paving the way for better efficiency and user experiences across the DeFi landscape.

FAQs

How do smart contracts help lower gas fees in DeFi?

Smart contracts help cut down gas fees in DeFi by automating tasks in a smarter way. Instead of relying on frequent manual inputs or repetitive on-chain transactions, they use decentralized automation networks to keep an eye on conditions and act only when certain criteria are met. This approach avoids wasting gas on unnecessary operations.

Another advantage is their ability to combine multiple actions into one transaction. By consolidating processes, smart contracts not only reduce costs but also make decentralized finance protocols run more efficiently.

How do Automated Market Makers (AMMs) simplify trading in DeFi?

Automated Market Makers (AMMs) play a key role in decentralized finance (DeFi), simplifying cryptocurrency trading by removing the need for traditional order books. Instead of relying on intermediaries, AMMs use smart contracts to establish liquidity pools where users can trade directly. This setup not only streamlines the process but also makes trading available around the clock.

Beyond trading, AMMs open the door for users to contribute liquidity to these pools and earn rewards in return. Their pricing operates through algorithms, ensuring trades are executed transparently and reflect the supply and demand within the pool. This creates a trading environment that’s both efficient and accessible to a broader audience.

How do smart contracts improve security in DeFi platforms?

Smart contracts play a key role in boosting security within DeFi by removing the need for intermediaries and relying on unchangeable and openly visible code. This setup allows transactions and processes to run automatically based on pre-established rules, cutting down the chances of human mistakes or fraudulent activities.

Because they operate on decentralized networks, smart contracts are also more resistant to manipulation by bad actors. Their automation guarantees that rules are enforced consistently, offering a safer and more reliable space for DeFi participants.